Pa Gift Tax 2025. Value of gifts given in 2025: The federal estate, gift, and gst tax exemptions for u.s.

Value of gifts given in 2025: The irs recently announced that the annual gift tax exclusion for tax year 2025 will increase to $18,000 for individuals and $36,000 for married couples filing jointly.

As of 2025, the annual gift tax limit is $18,000 for unmarried individuals and $36,000 for married couples.

Pa state tax Fill out & sign online DocHub, Under the 2025 federal gift tax guidelines you can gift up to $16,000 per year, to as many people as you want, before a gift tax return is required to be filed. The federal estate, gift, and gst tax exemptions for u.s.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The gift tax is imposed on the gifter and not the recipient. Under the 2025 federal gift tax guidelines you can gift up to $16,000 per year, to as many people as you want, before a gift tax return is required to be filed.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For couples, this exemption will equal $27.22 million. The irs recently announced that the annual gift tax exclusion for tax year 2025 will increase to $18,000 for individuals and $36,000 for married couples filing jointly.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, 40% gift and gst tax annual exclusion amount: These gifts can include cash as well as other.

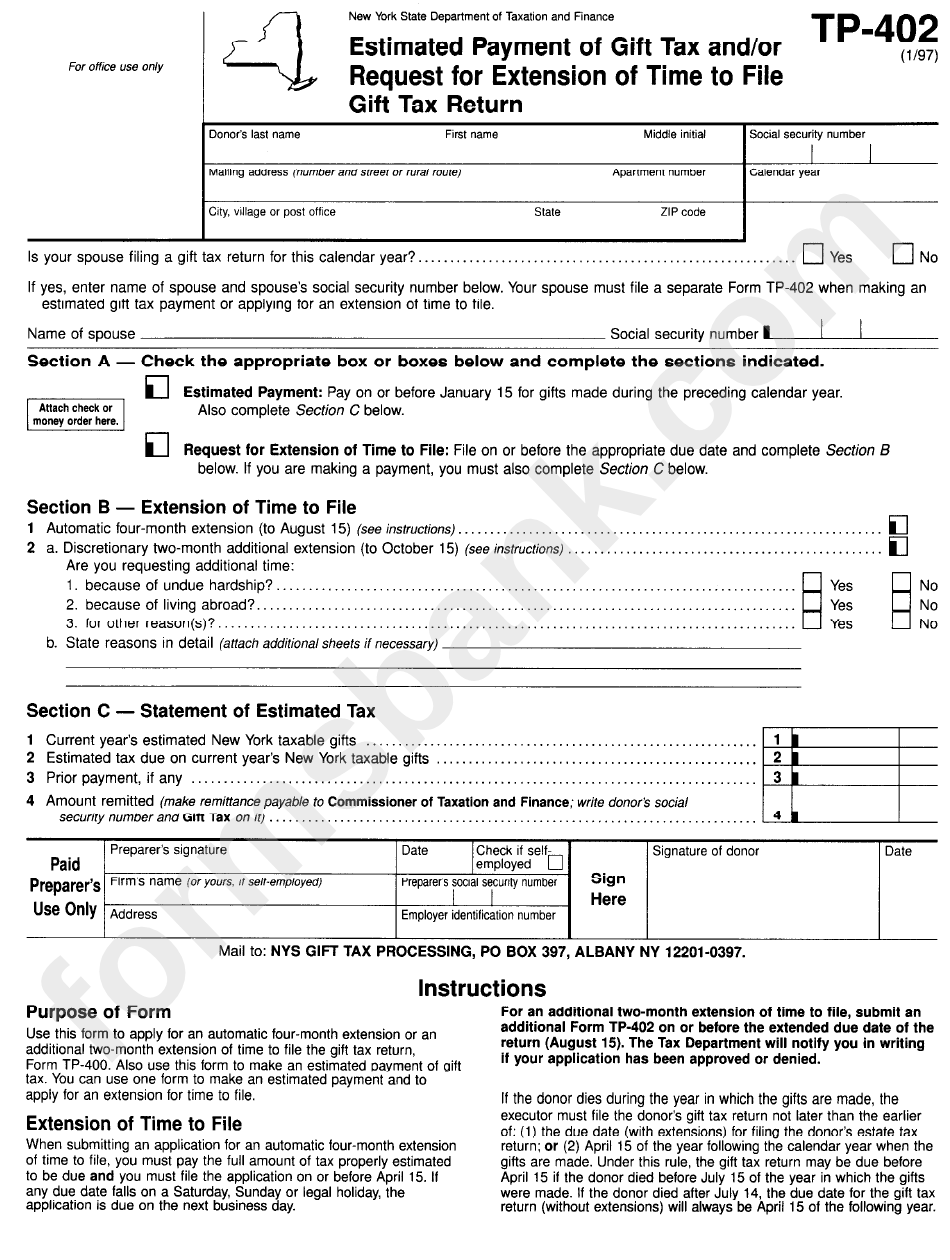

Form Tp402 Estimated Payment Of Gift Tax And/or Request For, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married. In 2025 it will increase to $13.61 million (up from $12.92 million in 2025).

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The gift tax is imposed on the gifter and not the recipient. In addition to taxing gifts, federal law also imposes a.

Tax rates for the 2025 year of assessment Just One Lap, The gift tax is intended to discourage large gifts that could. These gifts can include cash as well as other.

How do U.S. Gift Taxes Work? IRS Form 709 Example YouTube, $ value of gifts given before 2025: The irs recently announced that the annual gift tax exclusion for tax year 2025 will increase to $18,000 for individuals and $36,000 for married couples filing jointly.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, For example, a man could. Such gift can be in cash or in kind.

How to Avoid the Gift Tax? Diversified Tax, What is the federal estate tax. Friends ) is tax free upto limit of rs 50,000.

Travel Hiking WordPress Theme By WP Elemento