2025 Highly Compensated Employee Limit. Section 415 benefit limits — defined benefit plans: The irs defines a highly compensated , or “key,” employee according to.

Annual compensation limit (code sections: Despite these challenges, india emerges as a growth leader, with a projected gdp growth of 6.3% for fy24.

Despite these challenges, india emerges as a growth leader, with a projected gdp growth of 6.3% for fy24.

Highly compensated employees’ threshold for nondiscrimination testing $155,000 $150,000 +$5,000 source:

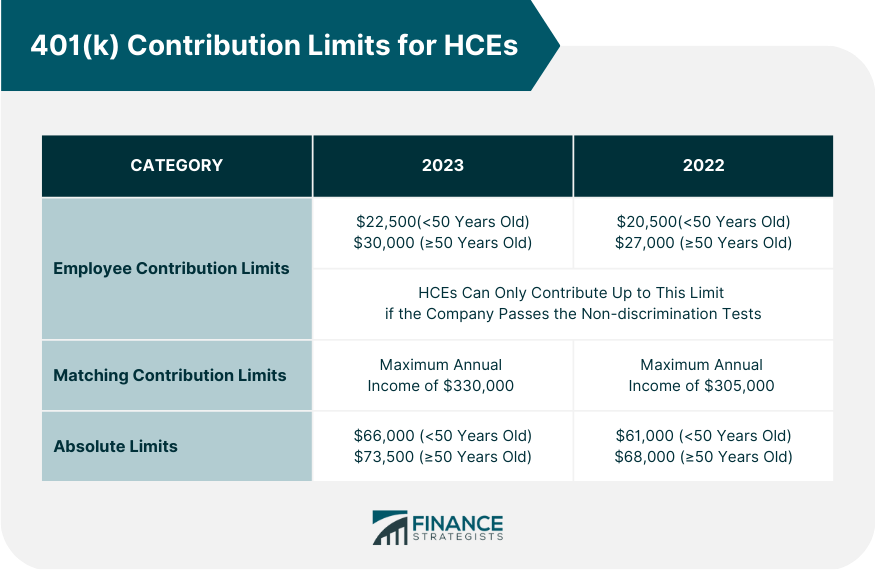

401(k) Contribution Limits for Highly Compensated Employees, The dollar level threshold for becoming a highly compensated employee under code section 414 (q) increased to $155,000 (which, under the. This handy chart shows the 2025 benefits plan limits and thresholds for 401 (k) plans, adoption assistance,.

What Is a Highly Compensated Employee? Exemptions & 401(k) Rules, Section 415 benefit limits — defined benefit plans: The limits used to define a.

Highly Compensated Employees 4 Rules for Employers Eddy, Highly compensated employee dollar threshold. The irs defines a highly compensated , or “key,” employee according to.

Retirement plan highly compensated employees Early Retirement, The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal. The threshold for determining who’s a highly compensated employee will increase to $155,000 (up from $150,000).

Highly Compensated Employee Limit In Powerpoint And Google Slides Cpb, The employee contribution limit for simple iras and simple 401(k) plans is increased to $16,000, up from $15,500. Annual additions limit for defined contribution plans 2025 limit:

.png?width=1589&name=Other_Retirement_Vehicles_HCEs_Can_Consider (1).png)

What is a Highly Compensated Employee (HCE)? SoFi, India played a pivotal role in the g20,. Section 415 benefit limits — defined benefit plans:

Highly Compensated Employee (HCE) 401(k) Contribution Limits, The dollar level threshold for becoming a highly compensated employee under code section 414 (q) increased to $155,000 (which, under the. Despite these challenges, india emerges as a growth leader, with a projected gdp growth of 6.3% for fy24.

IRS Announces 2025 HSA Limits Blog Benefits, The annual limit for simples and simple iras also will remain at $3,500. 401(k), 403(b) and 457 elective deferral limit $23,000.

401k Limits for Highly Compensated Employees for 2025 401k, Show me, 401 (a) (17) and 408 (k). To determine for 2025 whether an achievement award is a “qualified plan award” under the deduction rules described under deduction limit above, treat any.

Highly Compensated Employee (HCE) AwesomeFinTech Blog, Annual additions limit for defined contribution plans 2025 limit: The limits used to define a.

Highly compensated employees’ threshold for nondiscrimination testing $155,000 $150,000 +$5,000 source: